Recent developments

The decision (the “Decision“) of the Board of the Public Oversight, Accounting and Auditing Standards Authority (the “POA“) regarding the implementation of the Turkish Sustainability Reporting Standards (the “TSRS“) was published in the Official Gazette on December 29, 2023 and entered into force as of January 1, 2024. You can access the Decision here.

What’s new?

The Decision regulates the scope of the implementation of TSRS 1 “General Provisions on Disclosure of Sustainability-Related Financial Information” and TSRS 2 “Climate-Related Disclosures” standards, which are determined by the POA by considering the International Sustainability Reporting Standards for organizations, institutions and entities in Türkiye.

Who will be obliged to report on sustainability under TSRS?

According to the Decision, the following financial institutions and capital markets institutions will be obliged to report on sustainability:

a. Except those managed by the Savings Deposit Insurance Fund (the “SDIF“), Turkish banks.

b. The following financial institutions and capital markets institutions that that exceed at least two of the following thresholds (when considering the thresholds, an enterprise and its subsidiaries and affiliates will be regarded as a single enterprise).

- Total assets of bigger than TRY 500 million.

- Annual net sales revenue of higher than TRY 1 billion.

- At least 250 employees.

- Investment institutions

- Collective investment institutions

- Portfolio management companies

- Mortgage finance companies

- Central clearing organizations

- Central securities depositories

- Trade repositories

- Joint stock companies whose capital market instruments are traded on a stock exchange or other structured markets or which have a prospectus (izahname) or issuance certificate (ihraç belgesi) that has not expired

- Joint stock companies issuing non-share capital market instruments through private placement and not to be publicly traded (only until the end of the accounting period in which these capital market instruments are redeemed) and joint stock companies having an issuance certificate for this purpose which has not expired

- Rating agencies

- Financial holding companies

- Financial leasing companies

- Factoring companies

- Asset management companies

- Companies having qualified shares in financial holding companies

- Savings finance companiesInsurance, reinsurance and pension companies

- Precious metals intermediary institutions, and companies engaged in the production or trade of precious metals and other institutions that are permitted to operate in the Borsa Istanbul markets

Banks under management by the SDIF are not required to report on sustainability.

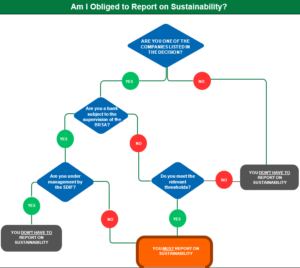

The POA published the following diagram to facilitate the interpretation of which companies would be required to report on sustainability.

Those enterprises obliged to report on sustainability because they have exceeded the thresholds above, will be obliged to report under TSRS from the following accounting period.

Entities that are not obliged to report on sustainability will be able to report on a voluntary basis.

Termination of the reporting obligation

Except the banks that are required to report irrespective of the thresholds above, entities subject to the scope of the implementation of the TSRS will be out of the scope of implementation as of the following accounting period if they do not meet the thresholds of at least two of the three criteria listed above in two consecutive accounting periods, or if they fall 20% or more below the thresholds of at least two of these criteria in an accounting period.

When considering whether thresholds are exceeded or not, financial statements for the last two years prepared in accordance with the legislation to which the enterprise is subject in terms of the total assets and annual net sales revenue and average number of employees for the last two years will be taken as a basis.

What are the transition principles?

Enterprises are not required to submit comparative information in the first reporting period in which they implement the TSRS, and they are not required to disclose Scope 3 greenhouse gas emissions in the first two annual reporting periods.

In addition, enterprises are allowed to report on sustainability for the first annual reporting period in which they apply the TSRS after publishing their financial reports for the relevant period.

Conclusion

With the Decision, it is becoming mandatory for many Turkish financial institutions and capital markets institurions to report on sustainability.

In 2020, the Capital Markets Board published the Sustainability Principles Compliance Framework which have not become mandatory to comply with. With the Decision, many enterprises are now report on sustainability. Please see here for our alert on the Sustainability Principles Compliance Framework.